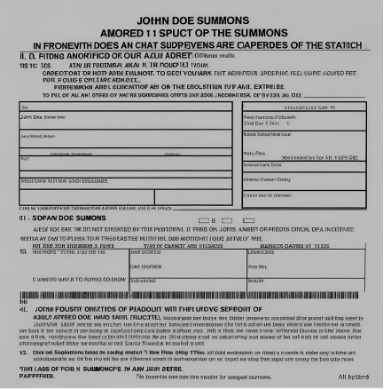

In this article, Porter Richards examines the IRS’s use of the John Doe Summons and its implications for Fourth Amendment privacy rights. He argues that while courts have upheld these summonses under the third-party doctrine, the rise of digital financial data challenges this framework. As technology evolves, stricter judicial oversight may be needed to balance tax enforcement with constitutional protections.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.